SMU Student Insurance

For active students of Singapore Management University from 1 July 2022 to 30 June 2025.

SMU Student Insurance

For active students of Singapore Management University from 1 July 2022 to 30 June 2025.

Underwritten by Income Insurance Ltd. Managed by MYCG & Partners Pte Ltd.

(photo source: The Straits Times)

Eligibility:

Registered active students of Singapore Management University (SMU):

Full-time local and international Undergraduate students

Full-time and part-time local and international Graduate students

Full-time Non-graduating students

Local NSMen who have matriculated as SMU students

Other student groups included or excluded as defined by SMU

Note:

Students of the Singapore Universities Student Exchange Programme (SUSEP) will be covered under their home university.

Students of the SMU-SUTD Dual Degree Programme will be covered under SUTD.

Local refers to Singaporeans or Singapore Permanent Residents.

Cessation of the student insurance coverage is based on a student's graduation date. (The day the dean clears the graduation list is the official graduation date. Please note that the graduation date is NOT the same as commencement date.)

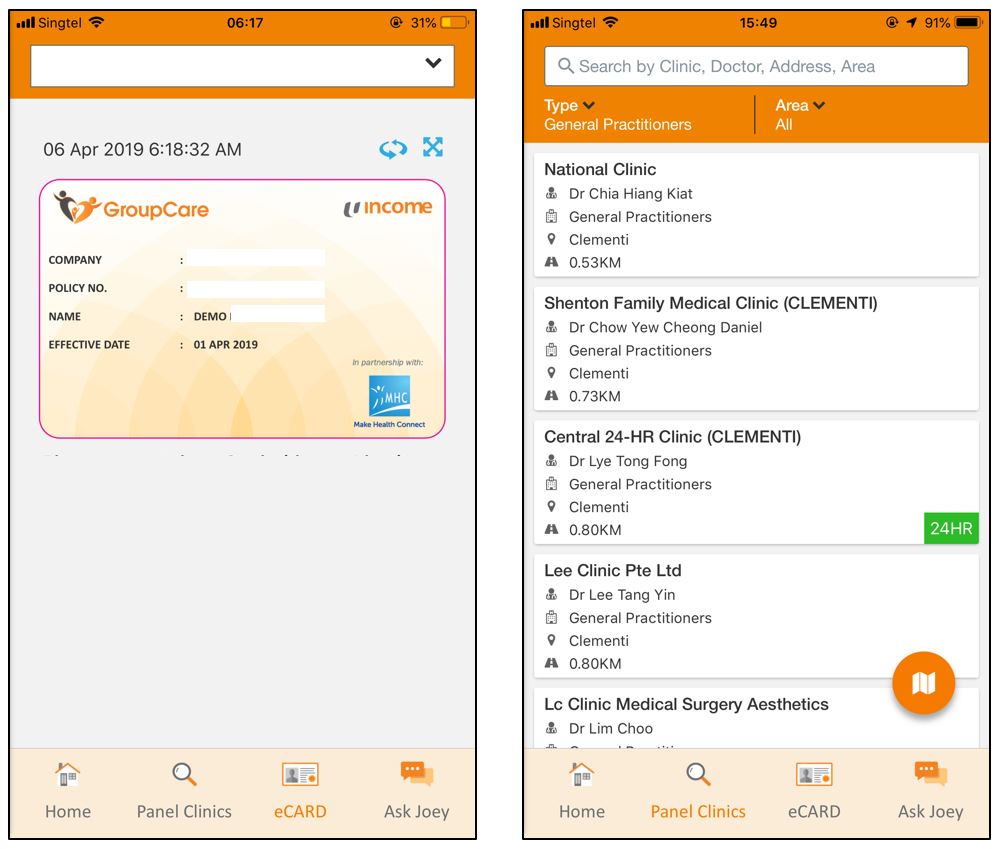

"GroupCare@Income" Mobile App & Web Portal

Features include e-Card for visit at panel clinics, find panel clinics, submit claims, track claims, apply for LOG, chat with “Ask Joey” etc.

"GroupCare@Income" Mobile App & Web Portal

Features include e-Card for visit at panel clinics, find panel clinics, submit claims, track claims, apply for LOG, chat with “Ask Joey” etc.

For first time user, please click “Register” to set-up your account before you can log in and use the app and portal.

Download the App from the Apple App Store or Google Play Store using your mobile phone

Or log in via the Portal

www.groupcareincome.com.sg

For more information on how to use the mobile app, download the User Guide:

e-Card & Panel Clinics

Show your e-Card and SMU Student Card to the clinic staff at panel clinics for cashless visit. You may have to top-up for non-standard (non-generic) medicine and surcharge after normal clinic operating hours.

e-Card & Panel Clinics

Show your e-Card and SMU Student Card to the clinic staff at panel clinics for cashless visit. You may have to top-up for non-standard (non-generic) medicine and surcharge after normal clinic operating hours.

You must show the e-Card from the GroupCare app and your NRIC/FIN card to the Panel Clinic to be eligible for coverage.

The SMU Student Card is not recognised at the panel clinics.

You must always check that the clinic is listed on the panel in the app before visiting.

Payments made at the panel clinics will not be reimbursible - you must show your e-card to the clinic staff.

Click the button for the list of panel clinics.

Please note that it may not include changes made since the list was last uploaded (eg. withdrawal of clinic). Please always check the app before your visit to ensure that the clinic is on the panel at the time of your visit - if you are asked to pay by a clinic that is no longer on the panel, the claim may not be admissible. You may also wish to contact the clinic before visiting in case there are changes eg. change in operating hours.

Coverage

Below is a summary of the insurance coverage. Please download the fact sheets for the details.

Coverage

Below is a summary of the insurance coverage. Please download the fact sheets for the details.

Frequently Asked Questions on Covid-19

All eligible students are covered under the following plans:

Group Outpatient Primary Care (GP)

Group Outpatient Specialist Care (SP)

Group Hospital & Surgical (GHS)

Group Personal Accident (GPA)

Group Outpatient Primary Care (GP)

Covers treatment by a General Practitioner (GP) for illness and injury, including consultation, prescribed standard medicine and basic x-ray and lab tests.

The student may have to top-up for non-standard medicine and surcharge after normal clinic operation hours.

Log in to the Groupcare@Income mobile app to obtain your e-card and view the list of panel clinics.

Show your e-card and NRIC/FIN at panel clinics for cashless visit. If the e-card is not shown and payment is made for the visit, please note that the visit will be processed as a non-panel clinic claim.

For teleconsult, please use the teleconsult feature in the Groupcare@Income app. Teleconsult outside of the app will be considered as non-panel claims (including clinics on our panel list as these are meant for physical visits).

Covers treatment in Singapore only.

For details and exclusions, please refer to the GP Fact Sheet here:

Group Outpatient Specialist Care (SP)

Covers treatment by a Specialist for illness and injury, including consultation, prescribed medicine and diagnostic tests. Referral by a GP is required.

Covers treatment in a Singapore Government Restructured Hospital Specialist Outpatient Clinic (SOC) only. Refer to the SP Fact Sheet for the list of Singapore Government Restructured Hospitals / SOCs.

Extends to cover an international student who returns to his/her home country for treatment. Charges incurred overseas will be covered up to overseas charges or B1 charges in a SOC, whichever is lower.

Covers outpatient physiotherapy at a SOC with referral by a Specialist.

Covers outpatient mental health treatment by a psychiatrist, psychologist and/or neurologist in a SOC or Private Specialist Clinic. Medical expenses incurred in a private specialist clinic shall be reimbursed up to 50% of the eligible expenses. Referral by a medical practitioner or SMU counsellor is required.

For details and exclusions, please refer to the SP Fact Sheet here:

Group Hospital & Surgical (GHS)

Covers reasonable expenses incurred for medically necessary hospitalisation and/or surgery treatment of illness or injury in a Singapore Government Restructured Hospital.

Covers emergency treatment while overseas and international students who return to their home country for treatment. Charges incurred overseas will be covered up to overseas charges or B1 charges in a Singapore Government Restructured Hospital, whichever is lower.

Refer to the GHS Fact Sheet for the list of Singapore Government Restructured Hospitals / SOCs.

Apply for Letter of Guarantee (LOG) at least 5 working days before hospitalisation/surgery, via the app/portal.

For details and exclusions, please refer to the GHS Fact Sheet here:

Group Personal Accident (GPA)

Pays upon death, permanent disablement and reasonable and necessary medical expenses for treatment of injury caused solely by an accident and not arising from sickness or pre-existing medical conditions.

24 hours worldwide cover.

For details and exclusions, please refer to the GPA Fact Sheet here:

Scenarios

The scenarios provide a general guide on what you should do in common situations. More will be added soon.

Scenarios

The scenarios provide a general guide on what you should do in common situations. More will be added soon.

Letter of Guarantee (LOG)

A LOG is a document issued by the insurer to guarantee hospitalisation/surgery expenses. It is not valid for pre or post hospitalisation/surgery, outpatient and overseas expenses. With a LOG, the hospital will waive the cash deposit and payment of the hospital bill up to the policy limits and subject to the policy terms and conditions. The hospital will bill the insurer directly. The student will have to pay to the hospital any amount not covered by the insurance after the hospital bill is finalised.

Letter of Guarantee (LOG)

A LOG is a document issued by the insurer to guarantee hospitalisation/surgery expenses. It is not valid for pre or post hospitalisation/surgery, outpatient and overseas expenses. With a LOG, the hospital will waive the cash deposit and payment of the hospital bill up to the policy limits and subject to the policy terms and conditions. The hospital will bill the insurer directly. The student will have to pay to the hospital any amount not covered by the insurance after the hospital bill is finalised.

Apply for LOG

Step 1

Click on the “Letter of Guarantee” icon in the app/portal and complete the online form at least 5 working days before the scheduled admission/surgery.

Step 2

Upload the following documents:

Care Cost Form / Financial Counselling Form / Admission Form / Day Surgery Authorisation Form - The hospital will give these documents to the patient when the admission date is confirmed. It should contain the diagnosis, name of surgery (if any) and estimated bill.

Referral letters, tests reports etc. if any

Step 3

For emergency hospitalisation/surgery, please call 6305 4573 or 9336 0159 after submitting the online form.

Step 4

The insurer will assess the case.

Step 5

View status of the LOG in the app/portal. If approved, the LOG will be forwarded to the hospital. Student can view a copy in the app/portal.

LOG request may NOT be approved for the following reason(s):

Late notification to the insurer of less than 5 working days (for planned elective admission only; does not apply for emergency case).

Completed authorisation form and other required medical documents are not available before discharge

Case requires further medical review

Non covered treatment/medical condition(s) under the policy

No credit arrangement with the Hospital

No LOG facility arrangement

Overseas admission

Note: Should the LOG request be declined, you must self-pay and submit the claim for evaluation. For claims evaluation, the decision on admissibility is subject to submission of all claim documents and assessment of complete claim documents according to policy terms, conditions and exclusions.

Claims

Submit your claims using the app or portal. No more hardcopy forms to complete!

Claims

Submit your claims using the app or portal. No more hardcopy forms to complete!

Submit & Track Claims

submit claims via the app or portal

upload your invoice/receipt and supporting documents like referral letter, discharge summary, test reports etc.

Students can check status of claims via the app or portal.

Notification of the result of the claim or request for documents/information will be sent via the app or portal.

Approved medical expense claims will be credited into the student’s bank account within 30 days after complete claim documents and information are received.

Important!

Claims should be submitted as soon as possible but within 30 days of the date of treatment or happening of the event whichever is earlier. If more time is required, please notify using the “Ask Joey” button in the app or portal. Late claims may not be processed.

Please refer to the fact sheets for the documents required to claim. Please do request from the clinic/hospital during the visit if the required documents (eg. referral letter, test report, discharge summary etc.) are not provided to you. Otherwise you may have to return to the clinic/hospital to request for it.

Please note that the insurer may request for further information/documents for assessment on a case by case basis.

Confirmation on whether a claim is admissible or the amount payable can only be provided by the insurer after complete claim documents have been submitted for assessment.

Original invoices and receipts must be kept for one (1) year from the date of treatment and provided to the insurer on request.

Medishield Life and the Private Integrated Shield Plans (excluding Rider) have Last Payer Status. This means that if they have paid the claim, the patient’s other insurance (eg. SMU’s student group insurance, Employer’s group insurance) must reimburse the Shield Plans. Please note that reimbursement to the Shield plan will reduce the balance available for future treatment/claims under SMU’s insurance. If you wish to retain the limit, please contact MYCG before submitting the claim.

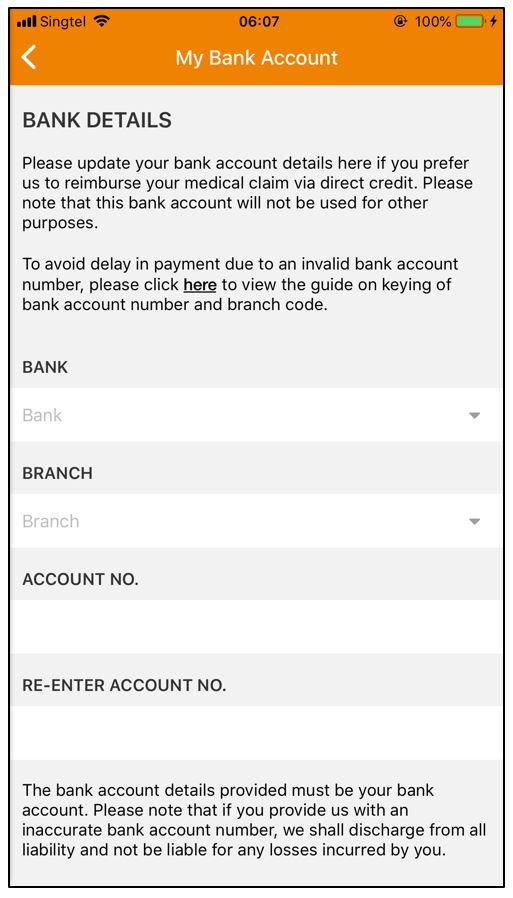

Bank Details

The student’s Singapore bank account details must be entered in the app/portal when submitting a claim. The details required include account number, bank code and branch code. Please do not provide bank details belonging to another party.

To enter your bank details, go to “Menu” then “Profile”.

Exception is made for certain groups of students who may not have a bank account in Singapore (e.g. short-term exchange students). An uncrossed cheque will be issued for the student to encash at a Singapore bank.

Contact

Contact

We will be at SMU Student Services Hub on Mondays and Wednesdays between 11am to 1pm. Please visit us!

View e-Card and Panel Clinics

Apply for Letter of Guarantee

Submit & Track Claims

Download GroupCare@Income mobile app

Log in to www.groupcareincome.com.sg portal

Let’s Chat

Click on “Ask Joey” in the app & portal

Request for Certificate of Insurance (COI)

Contact MYCG

smu@mycg.com.sg

+65 6305 4573 (24hr Income hotline)

+65 8118 6924 (MYCG)

+65 9336 0159 (24hr medical emergency hotline)