MOHH ANS Group Insurance

For Asian Nursing Scholars of MOH Holdings Pte Ltd

MOHH ANS Group Insurance

For Asian Nursing Scholars of MOH Holdings Pte Ltd

Managed by MYCG & Partners Pte Ltd & Karen Low

Underwritten by Income Insurance Limited

(photo source: mohh.com.sg)

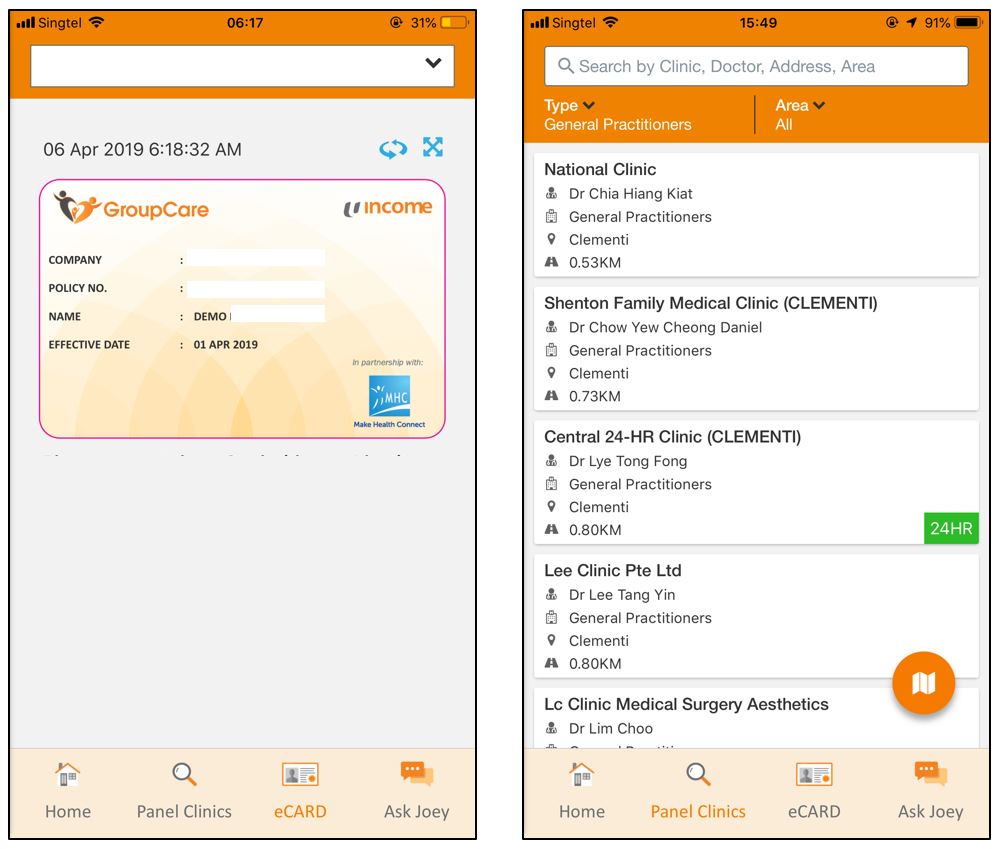

"GroupCare@Income" Mobile App & Web Portal

Features include e-Card for visit at panel clinics, find panel clinics, submit claims, track claims, apply for LOG, chat with “Ask Joey” etc.

"GroupCare@Income" Mobile App & Web Portal

Features include e-Card for visit at panel clinics, find panel clinics, submit claims, track claims, apply for LOG, chat with “Ask Joey” etc.

For first time user, please click “Register” to set-up your account before you can log in and use the app and portal.

Download the App from the Apple App Store or Google Play Store using your mobile phone

Or log in via the Portal

www.groupcareincome.com.sg

For more information on how to use the mobile app, download the User Guide:

e-Card & Panel Clinics

Show your e-Card and FIN Card to the clinic staff at panel clinics for cashless visit. You may have to top-up for surcharge after normal clinic operating hours.

e-Card & Panel Clinics

Show your e-Card and FIN Card to the clinic staff at panel clinics for cashless visit. You may have to top-up for surcharge after normal clinic operating hours.

Log in to view e-Card in app

Before you visit a Panel Clinic

always check that the clinic is on the panel

and the clinic’s operating hours

you may wish to contact the clinic to confirm their operating hours before your visit

Click the button for the list of panel clinics.

Please note that it may not include changes made since the list was last uploaded (eg. withdrawal of clinic). Please always check the app before your visit to ensure that the clinic is on the panel at the time of your visit - if you are asked to pay by a clinic that is no longer on the panel, the claim may not be admissible. You may also wish to contact the clinic before visiting in case there are changes eg. change in operating hours.

Coverage

Below is a summary of the insurance coverage. Please note that coverage is subject to the insurer’s policy terms conditions and exclusions.

Coverage

Below is a summary of the insurance coverage. Please note that coverage is subject to the insurer’s policy terms conditions and exclusions.

All eligible students are covered under the following plans:

Group Outpatient Primary Care (GP)

Group Outpatient Specialist Care (SP), Outpatient Mental Health and Outpatient Treatment for Clinical Attachment Incidents

Group Hospital & Surgical (GHS)

Group Term Life (GTL)

Group Outpatient Primary Care (GP)

Covers treatment by a General Practitioner (GP) for illness and injury, including consultation, prescribed standard medicine and basic x-ray and lab tests up to $400 per policy year with co-payment $5 per visit.

You may have to top-up for surcharge after normal clinic operation hours.

Log in to the Groupcare@Income mobile app to obtain your e-card and view the list of panel clinics.

Show your e-card and FIN Card at panel clinics for cashless visit.

If the e-card is not shown and you pay for the visit, please note that the visit will be processed as non-panel clinic claim.

Claim Examples:

Group Outpatient Specialist Care (SP)

Outpatient Mental Health Treatment

Outpatient Treatment for Clinical Attachment Incidents

Group Hospital & Surgical (GHS)

Covers reasonable expenses incurred for medically necessary hospitalisation and/or surgery treatment of illness or injury in a Singapore Government Restructured Hospital.

Apply for Letter of Guarantee (LOG) at least 5 working days before hospitalisation/surgery, via the app/portal.

Group Term Life (GTL)

Pays upon death, total & permanent disablement or diagnosis of a critical illness.

Letter of Guarantee (LOG)

A LOG is a document issued by the insurer to guarantee hospitalisation/surgery expenses. It is not valid for pre or post hospitalisation/surgery or outpatient expenses. With a LOG, the hospital will waive the cash deposit and payment of the hospital bill up to the policy limits and subject to the policy terms and conditions. The hospital will bill the insurer directly. The student will have to pay to the hospital any amount not covered by the insurance after the hospital bill is finalised.

Letter of Guarantee (LOG)

A LOG is a document issued by the insurer to guarantee hospitalisation/surgery expenses. It is not valid for pre or post hospitalisation/surgery or outpatient expenses. With a LOG, the hospital will waive the cash deposit and payment of the hospital bill up to the policy limits and subject to the policy terms and conditions. The hospital will bill the insurer directly. The student will have to pay to the hospital any amount not covered by the insurance after the hospital bill is finalised.

Apply for LOG

Step 1

Click on the “Letter of Guarantee” icon in the app/portal and complete the online form at least 5 working days before the scheduled admission/surgery.

Step 2

Upload the following documents:

Care Cost Form / Financial Counselling Form / Admission Form / Day Surgery Authorisation Form - The hospital will give these documents to the patient when the admission date is confirmed. It should contain the diagnosis, name of surgery (if any) and estimated bill.

Referral letters, tests reports etc. if any

Step 3

For emergency hospitalisation/surgery, please call 6305 4573 or 9336 0159 after submitting the online form.

Step 4

The insurer will assess the case.

Step 5

View status of the LOG in the app/portal. If approved, the LOG will be forwarded to the hospital. Student can view a copy in the app/portal.

LOG request may NOT be approved for the following reason(s):

Late notification to the insurer of less than 5 working days (for planned elective admission only; does not apply for emergency case).

Completed authorisation form and other required medical documents are not available before discharge

Case requires further medical review

Non covered treatment/medical condition(s) under the policy

No credit arrangement with the Hospital

No LOG facility arrangement

Overseas admission

Note: Should the LOG request be declined, you must self-pay and submit the claim for evaluation. For claims evaluation, the decision on admissibility is subject to submission of all claim documents and assessment of complete claim documents according to policy terms, conditions and exclusions.

Claims

Submit your claims using the app or portal. No more hardcopy forms to complete!

Claims

Submit your claims using the app or portal. No more hardcopy forms to complete!

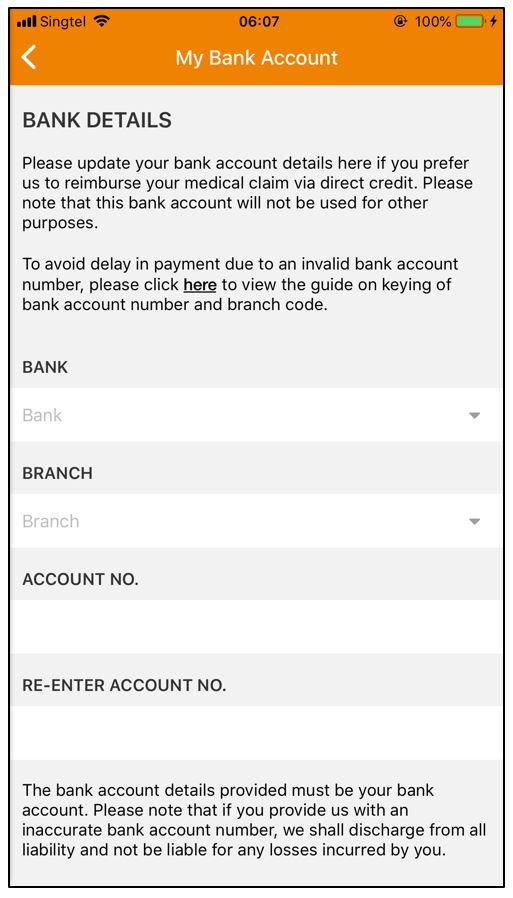

Bank Details

Your Singapore bank account details must be entered in the app/portal before submitting a claim. The details required include account number, bank code and branch code. Please do not provide bank details belonging to another party.

To enter your bank details, go to “Menu” then “Profile”.

Submit & Track Claims

submit claims via the app or portal

upload your invoice/receipt and supporting documents like referral letter, discharge summary, test reports etc.

you can check status of claims via the app or portal

notification of the result of the claim or request for documents/information will be sent via the app or portal

approved medical expense claims will be credited into the student’s bank account within 30 days after complete claim documents and information are received.

Important!

Claims should be submitted as soon as possible but within 30 days of the date of treatment or happening of the event whichever is earlier. If more time is required, please notify using the “Ask Joey” button in the app or portal. Late claims may not be processed.

Original invoices and receipts must be kept for one (1) year from the date of treatment and provided to the insurer on request.

Contact

Contact

View e-Card and Panel Clinics

Apply for Letter of Guarantee

Submit & Track Claims

Download GroupCare@Income mobile app

Log in to www.groupcareincome.com.sg portal

Let’s Chat

Click on “Ask Joey” in the app & portal

Contact MYCG

claims@mycg.com.sg

+65 9762 2062 (May Yee)

+65 9336 0159 (24-hr hotline for emergency hospital admissions/LOG only)